Time-Series Data Animation

We make data into tools that can be easily understood and shared. If 'data is the new oil' then Pacemaker.Global is the refinery that makes public and central bank data dynamic, engaging and relevant.

Contact us at info@Pacemaker.Global if you would like us to bring your data off the page and animate it for sharing.

Dominant Currency Export Pricing

We all learn from each other's experience as well as our own. Comparing performance across countries and across time we gain insights about risk and resiliency that can inform better policy choices.

Are EU nations that export more in USD more prone to crisis?

Using IMF data on export currency denomination we were able to build this super little animation. Only after we watched it a few times did we notice that countries that have more exports in USD are more vulnerable to financial crisis.

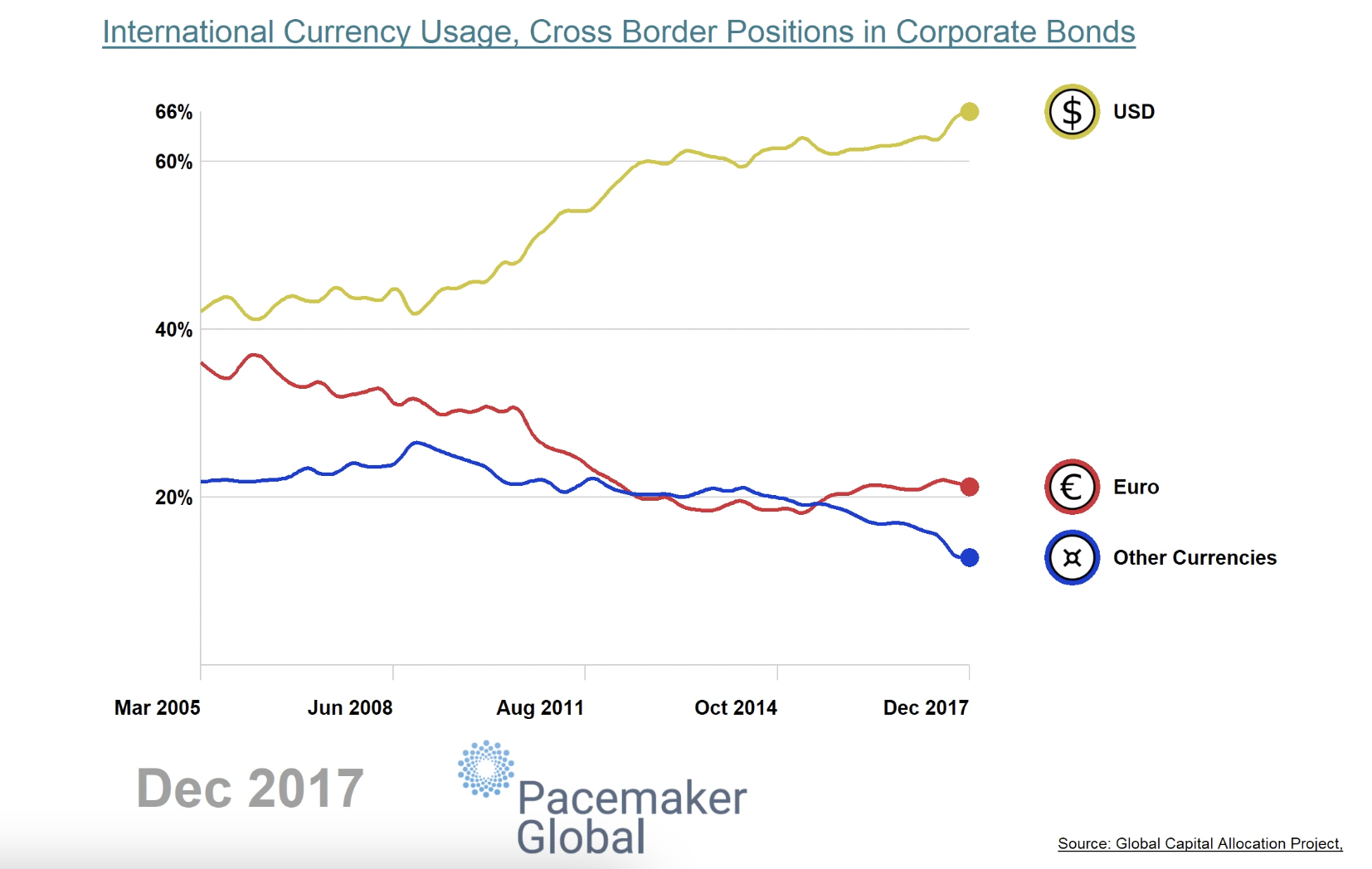

Cross Border Positions in Corporate Bonds

The Global Capital Allocation Project data shows the growing dominance of US dollar as corporate funding currency. Policy makers may wish to consider the implications for domestic financial stability given recent foreign exchange and interest rate volatility.

South Africa

Our favourite way to monitor global systemic risk and vulnerability is BIS Table C3 for Banks and Non-Bank Financial Corporations. Below you can compare the different dynamics of USD and EUR debt growth for Poland, India, and South Africa. Very different countries, but common challenges from vulnerability to foreign exchange and credit instability.

South Africa: Banks and Other Financial Corporations compared to Non-Bank Financial Corporations

Watch as EUR and USD debt securities grow relative to borrowings in ZAR and other currencies.

Non-Financial Corporations show different behaviours in foreign currency financing when compared to Banks and Other Financial Corporations.

Poland

Better insights

Poland had a very severe financial crisis due to excessive borrowing by banks, businesses, and mortgage borrowers in foreign currency leading into the Great Financial Crisis of 2008.

By monitoring growth of foreign exchange debt, supervisors can better prepare for instability.

India

The World's Most Populous Nation

India likely became the world's most populous nation with 1.4 billion people toward the end of 2022, as the world population exceeded 8 billion.

India's banking and financial sector are very highly developed and closely integrated with the global economy.

India chooses independent policies, neutrality, and cooperation with regional partners and global partners.