Gilts and Gold (Venezuelan Gold)

Commentary by Kathleen Tyson - October 12, 2022

Twitter and newspaper headlines shift responsibility from the Bank of England to the Truss government almost hourly in the raging gilts and currency crisis. I suggest the gilts crisis started when the UK followed the US in confiscation of Central Bank of Venezuela official monetary and gold reserves in 2019.

Central banks hold official reserve assets with each other because central bank peer custody is deemed 'risk free'. Many central banks hold gold with the Bank of England for historic reasons of convenient settlements in gold dating back to the 19th century, when gold was the hegemonic asset for international payment.

John Bolton admitted in his book that the Trump administration recognised the exiled Guaido sect (it isn't a Venezuelan party, a regime, or a government) with the primary motivation to expropriate central bank official reserves. Some of the USD reserves seized in 2019 were used to fund the pathetic Bay of Piglets coup attempt in 2020.

The more I thought about it, the more I realized that the decision of political recognition was more important now than the oil sanctions. First, recognition by the United States would have greater implications for the Federal Reserve Board, and therefore for banks around the world. The Fed would automatically hand over control of the assets of the Venezuelan government that it owned to the government led by Guaidó. Unfortunately, as we would find out, the Maduro regime had been so efficient in stealing or wasting those assets that there were not many left.

A more rational construction is that Venezuela had wisely cut its holdings of USD assets to prevent seizure by a hostile Washington. Russia has reduced USD holdings since 2014, and China has been divesting USD assets since the 2019 Venezuelan sanctions. A more general divestment of USD assets has accelerated with Russian sanctions this year. US TIC data show foreign official holdings of US Treasuries down 7.34% to July 2022 year on year.

Bolton then convinced the Johnson government to follow suit, seizing the much larger $1 billion of gold reserves held in custody of the Bank of England.

UK Foreign Minister Jeremy Hunt, who was in Washington for meetings, was delighted to cooperate with measures they could take, for example, to freeze Venezuelan gold reserves at the Bank of England, even if the regime did not I could sell the gold to continue standing.

For me, this one decision put the UK on the road to a gilts crisis. Why would any nation hold assets in a country so weak that it throws away 1000 years of non-discriminatory commercial rule of law and centuries of international diplomatic norms on the neutrality of reserves? Why would any country be creditor to the UK (or the US, EU, Japan, etc.) if the debtor will try to destabilise and overthrow the creditor government?

The UK Debt Management Office doesn't publish data equivalent to the US Treasury TIC data. IMF COFER data show official reserves in GBP fell in Q2, along with sharp falls in other states sanctioning Russia. The US share grew, largely thanks to UK purchases (single largest buyer, $93 billion). Markets report foreigners were strong net sellers of gilts in Q3 2022. The Truss government decision to call China 'a threat' is a very risky challenge to a major creditor and illogical (no foreign military adventures since WWII).

Gilts divestment started with the extraordinary sanctions on Venezuela, then accelerated this year with sanctions on Russia. Without foreign creditors, the UK cannot sustain its large trade and fiscal deficits. So now we get the pound and the gilts crises.

Finger pointing will continue between the City and Westminster today, but one cause of the gilts crisis is the UK debasing its own rule of law to follow US sanctions in 2019.

The Venezuelan gold expropriation is up for reconsideration. The UK courts have one last chance to show the world that rule of law is still a UK value. If the courts continue to support expropriation, expect global divestment of gilts to continue.

The name gilts comes from the gold edging that certificates used to indicate UK sovereign debts were 'as good as gold'. Ironic.

[UPDATE 24 MAY 2023]

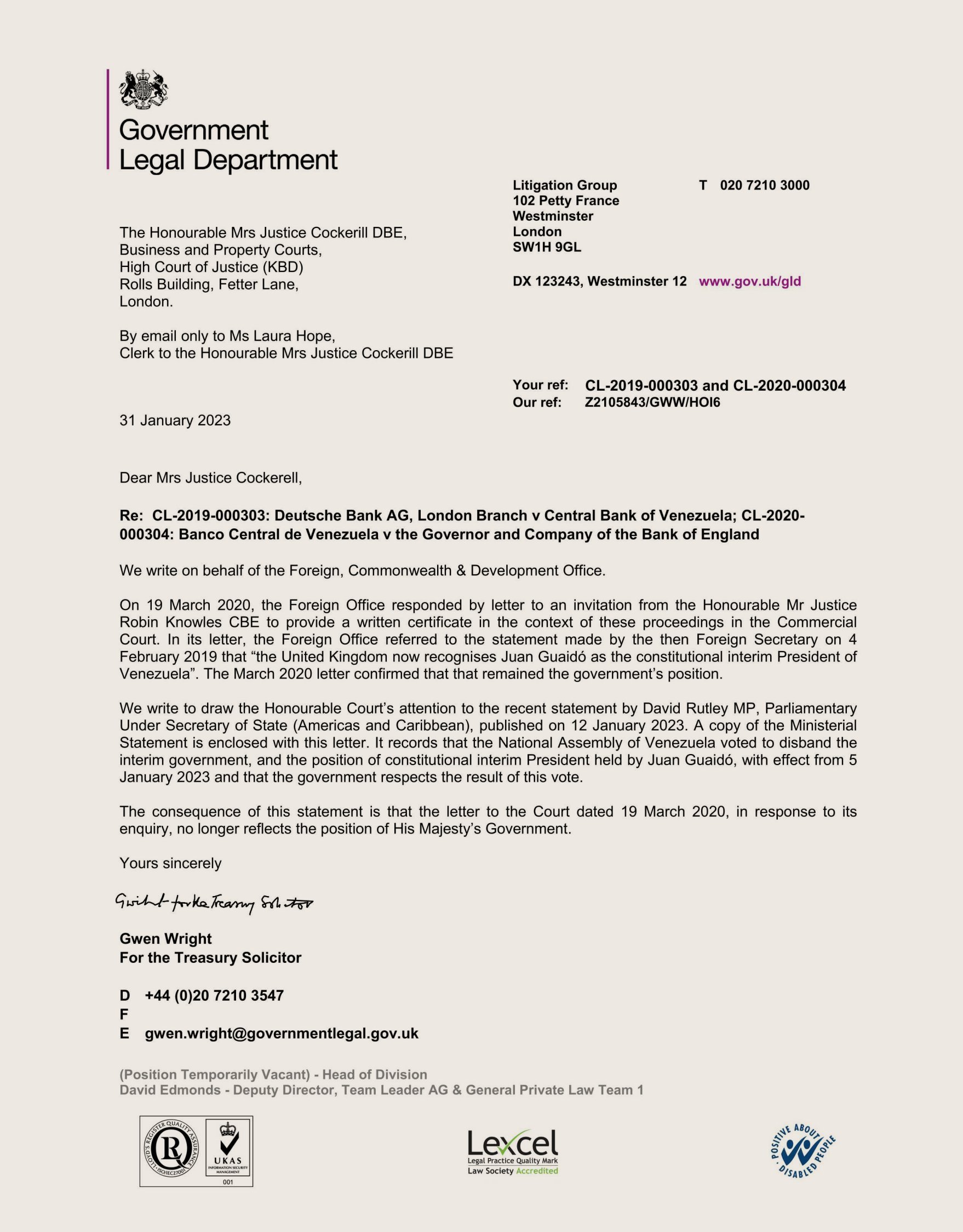

The UK Foreign Office has belatedly confirmed that it no longer recognises the opposition as the government of Venezuela following Guaido's permanent relocation to his Florida mansion. The letter does not clarify whether the gold expropriated in 2019 at the request of John Bolton will be returned to the Central Bank of Venezuela.

Still, there is some hope for rule of law and British justice.