50 Years Ago Today the USA Repudiated Bretton Woods

Commentary by Kathleen Tyson - August 15, 2021

On 15 August 1971, in a speech broadcast on American television, pre-empting Bonanza, President Nixon announced that he was 'temporarily' closing the Gold Window that allowed other nations to exchange USD for gold at $35 per ounce. The Bretton Woods Treaty obligations had provided global monetary stability since 1944. Unilateral repudiation of the Treaty ended a period of global monetary cooperation that had restored and grown the economies of both allies and enemies. It also ended more than 4,000 years of metals-based money in favour of floating, fiat currencies.

That was just the beginning of an extraordinary period of creative central bank policy-making and monetary policy innovation.

The unilateral repudiation of Bretton Woods was hugely popular with Americans, even though it roiled the economies of the rest of the world. Then as now, the US economy and USD outperform other economies and currencies under conditions of shock or instability.

While USD could no longer be redeemed for gold, enabling the rapid scaling of US trade and fiscal deficits that still distinguish American exceptionalism, many aspects of the Bretton Woods System did not change.

The foreign exchange markets set up after World War II were all quoted in USD and mostly settled in USD against other currencies. FX trading grew very, very rapidly as currencies that had been fixed were forced to float - spurring a whole industry of short-term speculative FX trading that has little relevance to trade or longer-term economic performance. CLS Bank - which I helped design and build - now settles a peak USD 14 trillion in daily FX settlements. The Federal Reserve Bank of New York's primary dealers became the dominant FX dealer banks. They globalised to meet the demand for FX trading, settlements, and hedging, and then financialised all open economies with substantially higher levels of debt, leverage, and systemic risk.

The USD briefly depreciated against rival currencies, the Japanese Yen and German Deutschemark, but the structural influences favouring USD dominance in global transactions soon gained renewed traction. Secretary of State Henry Kissinger negotiated a deal with OPEC dictating that oil could only be sold globally in USD. Similar pressures were exerted in many other trade sectors.

The World Bank and IMF rapidly increased lending to emerging markets and developing economies, all in USD as conditioned in their charters. American banks also increased lending to the developing world in USD. The development of Eurodollar bond markets in London globalised USD borrowing for countries and corporations everywhere.

Many governments, banks, and corporations borrowed, lent, and invested in USD assets in preference to their own less liquid, more expensive, more volatile local currency funding markets and assets. Political instability accelerates dollarisation, so the turbulent and often violent 1970s and 1980s - and particularly the Third World Debt Crisis, terrorism in European cities, and many violent military coups - spurred ever greater dollar dominance. The fall of the Berlin Wall, collapse of the Soviet empire, and peaceful rise of a mercantile Asia further solidified USD dominance.

Even in Europe, a more politically stable region because of the European Union, some countries dollarised their economies, remaining heavily dollarised even after the introduction of the EUR.

Structural elements of the global financial system remain heavily biased to USD, but the world should worry more about this. Any shock or crisis - even one originating in the USA like the collapse of Lehman after years of mortgage-backed securitisation frauds and excesses - exports pain globally much worse than the USA experiences. Federal Reserve Bank of New York Primary Dealers report record global profits in the midst of every crisis, almost certainly derived from their preferential access to USD liquidity facilities, inside knowledge of market margin policies, and dominance as prime brokers to more than USD 4 trillion in hedge funds. The dynamic means that each successive crisis accelerates USD dominance, concentration toward US primary dealers, and global systemic vulnerabilities.

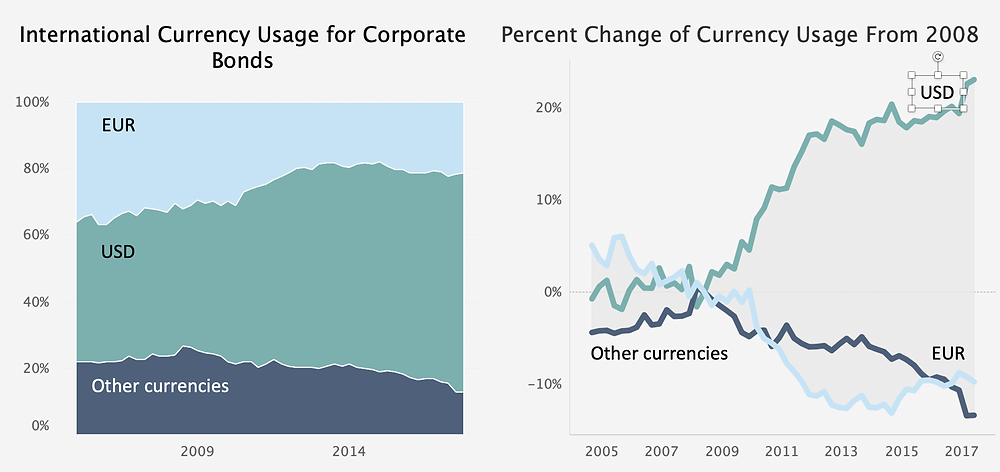

Dominant currency borrowing in corporate bonds since 2008