Angell Paradox II: Western securities markets are destabilised by sanctions

Commentary by Kathleen Tyson - March 8, 2022

Angell Paradox: You loot, you lose.

The anti-Russia sanctions imposed by the West have torn up the fragile premise of non-discriminatory investor and financial legal protections, claims, and rights that supported global investment in Western banking and capital markets for over a hundred years. Markets for bonds and equities are now trading down, while markets for minerals, energy, and food commodities are surging. Higher, wider, and longer lasting inflation with lower growth are certain, but global financial market dysfunction and a liquidity crisis are now also in prospect. We are all poorer than we were two weeks ago, and we will be poorer still before Russian tanks turn back from Ukraine.

All four price gauges on the Bloomberg Tracker have breached their normal range. Eurozone industrial producer prices look the most overheated, rising in January about 30% year-on-year, a record pace. The energy sub-index jumped more than 85%.

In response to Russia's 'special military operation' in Ukraine the nations of the West formed an orderly circular firing squad and fired round after round of unprecedented economic and financial sanctions. More than 2,750 sanctions make Russia the most sanctioned nation ever. As a nation running fiscal, trade, food, and energy surpluses, Russia may prove relatively resilient. Russian gold reserves, as well as mineral, energy and food exports have all been revalued higher. The biggest casualties of the sanctions may be the Western nations themselves and neutral nations that relied on global energy, food, credit, and supply chain stability for their economic and monetary stability.

I am worried by the lack of rationale, proportionality, and precedent for the nature and scale of sanctions against Russia. More than 14,000 dead and 30,000 wounded (OSCE compiled data) in the Donbass region of Ukraine over 8 years preceding this conflict invited much less outrage and no sanctions at all. The UN's report of 474 civilian deaths in the Russian-Ukraine conflict as of today includes deaths in the Donbass. All deaths are tragic, but the Russian-inflicted losses are still very low compared to all NATO-led attacks on civilian populations of Yugoslavia, Afghanistan, Iraq, Libya, and Syria (collectively over 900,000 deaths and 30 million refugees). Would the West accept similar sanctions as justified after it starts its next war of choice?

These sanctions look particularly bad in overturning decades of legal expectations. I'm pretty sure no bond or equity prospectus or broker trading terms disclosed to investors that securities could be summarily frozen or expropriated by executive fiat if the government took a dislike to the nationality of the investor. Exchange rulebooks don't provide for summary exclusion based on nationality. National bank regulation doesn't stipulate selective nationality-based license revocation with asset freezes and seizures against fully compliant foreign banks and branches.

In general a prospectus says that all investors have equal claims and rights in proportion to their investment, but that clearly isn't the case any longer for Western bonds and equities. Exchange rulebooks provide member access unless there is a violation of rules, but that clearly isn't the case any longer for Western exchanges. Supervisory regulations stipulate foreign bank capital adequacy and conduct of business standards, not nationality-based disqualification with summary asset freezes and seizures.

As of last week Russian banks, bond holders, and equity investors can lose their investments if Western governments choose to strip them away based on nationality without any declaration of war. Exchanges can kick out Russian members even if they have not violated any rules. Russian banks and corporations lose their trading authorisation and have assets frozen despite no misconduct or breach of regulations. Sanctions change the risks of global investment and participation in Western economies and markets quite dramatically. Violation of well-established legal, commercial and regulatory norms may appeal short-term, but anti-Russian sanctions undermine all Western assets, markets and financial systems in the longer-term.

In wartime seizing enemy assets is accepted under international law. Without a declaration of war it looks like Western lawlessness that violates contractual, credit, commercial and supervisory norms that have evolved over centuries. The distinction is one that may be lost on Western leaders, but it was acknowledged in Moscow. President Putin said the sanctions, freezes, and seizures in the West were 'akin to an act of war'. He is correct. Unfortunately we all lose this war.

Week 1 sanctions froze the official reserves of the Central Bank of the Russian Federation, and cash and assets of the Russian sovereign wealth fund, Russian banks (exempting oil and gas finance banks), Russian corporations (exempting oil and gas sector), and hundreds of Russian officials and oligarchs as individuals. These sanctions overthrew centuries of diplomatic principles and statecraft as well as the West's own assertions of non-discriminatory rule of law as the basis for international commerce and investment. The revaluation of Russian assets to zero and volatility in commodities, debt and equities have created a massive risk reassessment as commodities surged and securities tanked.

Week 2 sanctions extended to the Russian oil and gas sectors and to Belarusian banks, even though Belarus is a non-combatant. This spurred even wider selling of Western securities, including government bonds which historically benefit from risk-off trading, and much sharper price increases in energy, food, and mineral markets. The LME has been forced to suspend trading in Nickel after a two-day surge of more than 250 percent triggered margin calls which some short members could not meet in a one-day timeframe. Margin calls in leveraged Western markets more generally can only be met by further global asset sales. That risks wider market dysfunction and a global liquidity crisis.

Premier Xi of China today warned French President Macron, Western sanctions were "getting out of control" and "will deal a blow to the stability of global finance, energy, transportation and supply chain, dragging down the world economy amid the pandemic." Xi clearly understands the Angell Paradox.

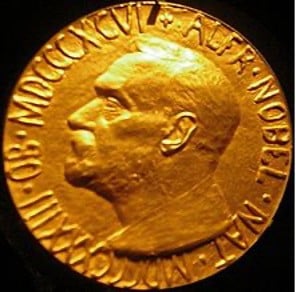

Sir Norman Angell won the 1933 Nobel Peace Prize for his insight inThe Great Illusion (first published 1910) that whoever wins a war between two developed, interconnected nations, profit from war is impossible. If the victor expropriates from the vanquished they undermine the legal certainty and commercial usage essential to cross-border trade, credit, and joint enterprise. All similar undertakings must be discounted against expropriation risk, rendering everyone in interdependent, developed economies poorer.

Sanctions provide a mechanism for non-combatant Western nations to freeze and expropriate assets from Russian-nationality banks, investors, and individuals, and halt future commerce and trade. They have the effect of undermining the legal certainty and commercial usage essential to all cross-border trade, credit, investment, and joint enterprise. Russia's energy, mineral, and agricultural wealth is being re-weighted as more valuable in global markets; Western currencies, securities, and capital markets are being destabilised by volatility and re-weighting as less valuable. It's self-inflicted destabilisation by the sanctions states, only everyone in our interconnected world suffers too.

This is second in a series about the Angell Paradox. The first suggested dollar dominance is compromised.