Angell Paradox IV: Transitioning to Bretton Woods III

Commentary by Kathleen Tyson - March 24, 2022

On 7 March 2022, after Western governments froze the official reserves of the Central Bank of the Russian Federation, Zoltan Poszar of Credit Suisse wrote that Bretton Woods III is now emerging. The new monetary order will be backed by Eastern gold and commodities rather than Western sovereign debt. He concludes: "After this war is over, 'money' will never be the same again . . ."

Zoltan headed the Open Market Desk at the New York Fed and worked for the US Treasury. He is not some anti-Western conspiracy theorist. He is uniquely knowledgeable about the internal structures of monetary order. These have fundamentally failed under Western sanctions against Russia, Russian banks, Russian corporations, Russian individuals, and widened in recent days to Belarus and China.

Western financial sanctions breach the conditions under which Western nations issued their huge sovereign debts to their creditors. Western economic and trade sanctions bring the Western system of capital markets, cross-border commercial investment, and commodities markets into hazard.

Bretton Woods II - and the Basel Capital Accords - obliged the central banks and commercial banks of the world to hold and trade in dominant currencies backed by nothing more than ever greater sovereign debts of the US, EU, UK, and Japan. Their debts grew faster than their economies while their collective share of a rapidly growing global economy shrank. Freezing, seizing, and expropriating official and bank reserves broke the global confidence in Bretton Woods II necessary to its continuance as a monetary order.

USA debt to GDP as of 2021 is 133.28%

Euro area debt to GDP as of 2021 is 98.92%

UK debt to GDP as of 2021 is 108.5%

Japan debt to GDP as of 2021 is 256.86%

The inflation and volatility we are seeing now in commodities markets is the world adjusting to the new monetary order that values Eastern and Southern commodities and what they can build more than sovereign debts of today's dominant currency issuers. This reset will be messy and unpredictable as it implies a decoupling of Western and Eastern currencies, capital markets, and commodities markets.

Political instability, strikes, and civil unrest always accompany inflation, in both democratic and authoritarian nations. Political instability also has costs, undermining investment, commercial contract, and consumer confidence. Strikes stoke higher, wider inflation. Civil unrest damages property and investments. None of us, not even Zoltan, knows where this leads . . .

UPDATE: Putin's order yesterday that 'unfriendly countries' will pay for natural gas in roubles from next week effectively makes the rouble a gas-backed currency. Putin commented when he made the order, "The collective west has killed all trust in their currencies.” This gives real weight to Poszar's prediction. The rouble leapt to a three week high against USD.

The Angell Paradox: You loot, you lose.

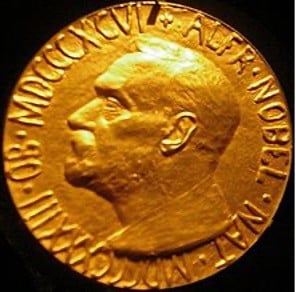

Sir Norman Angell won the 1933 Nobel Peace Prize for his insight in The Great Illusion (first published 1910) that whoever wins a war between two developed, interconnected nations, profit from war is impossible. If the victor expropriates from the vanquished they undermine the legal certainty and commercial usage essential to cross-border trade, credit, and joint enterprise. All similar undertakings must be discounted against expropriation risk, rendering everyone in interdependent, developed economies poorer.

Sanctions provide a mechanism for non-combatant Western nations to freeze and expropriate assets from Russian-nationality official institutions, banks, investors, and individuals, and halt future commerce and trade. They have the effect of undermining the legal certainty and commercial usage essential to all current and future cross-border trade, credit, investment, and joint enterprise. Sanctions cause self-inflicted destabilisation, only everyone in our interconnected world loses too.

This is fourth in a series about the Angell Paradox. The first suggested dollar dominance is compromised, the second that sanctions destabilised Western securities markets, and the third that yacht seizures would prove hugely expensive for Western expropriators.