Inflation expectations are not what they used to be

Commentary by Kathleen Tyson - October 21, 2021

UPDATE 29/10/21: Inflation notches a fresh 30-year high as measured by the Fed’s favorite gauge

Inflation is like plumbing. Once you are forced to discuss it openly it is too late for preventative maintenance and you likely face a costly disaster unless corrective action follows swiftly. Unfortunately, central banks have not had much practice 'taking away the punch bowl just when the party gets going' since the innovation of the Greenspan Put on 20 October 1987 (followed by the Bernanke, Yellen and Powell puts and the Draghi 'whatever it takes' put). Accelerating inflation may force their hand.

For years central banks have looked at consumer expectations of inflation as a leading indicator of inflationary pressures. Two new papers, one from the Board of Governors of the Federal Reserve and one from the European Central Bank, put the policy practice to the test and find it wanting.

Why Do We Think Inflation Expectations Matter for Inflation? (And Should We?)

Abstract

Economists and economic policymakers believe that households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.

Do inflation expectations improve model-based forecasts?

Abstract

Those of professional forecasters do. For a wide range of time series models for the euro area and its member states we find a higher average forecast accuracy of models that incorporate information on inflation expectations from the ECB’s SPF and Consensus Economics compared to their counterparts that do not. The gains in forecast accuracy from incorporating inflation expectations are typically not large but significant in some periods. Both short- and long-term expectations provide useful information. By contrast, incorporating expectations derived from financial market prices or those of firms and households does not lead to systematic improvements in forecast performance. Individual models we consider are typically better than univariate benchmarks but for the euro area the professional forecasters are more accurate, especially in recent years (not always for the countries). The analysis is undertaken for headline inflation and inflation excluding energy and food and both point and density forecast are evaluated using real-time data vintages over 2001-2019.

Central bankers like to talk about inflation expectations because it is much less controversial and invites less criticism than openly discussing the reality of accelerating inflation. Expectations provide cover to kick the policy can down the road, even if they are useless as a guide to better policy or forecasts.

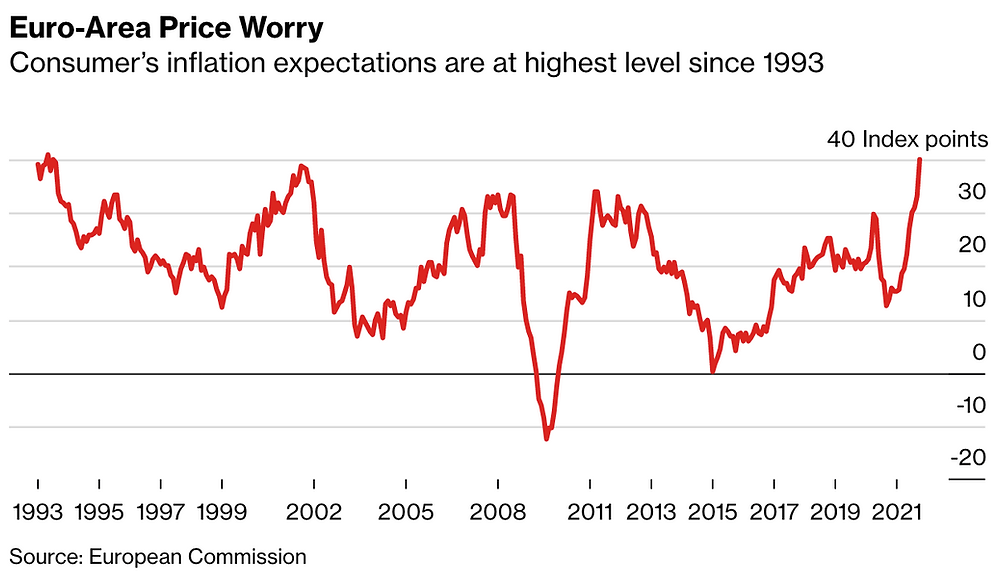

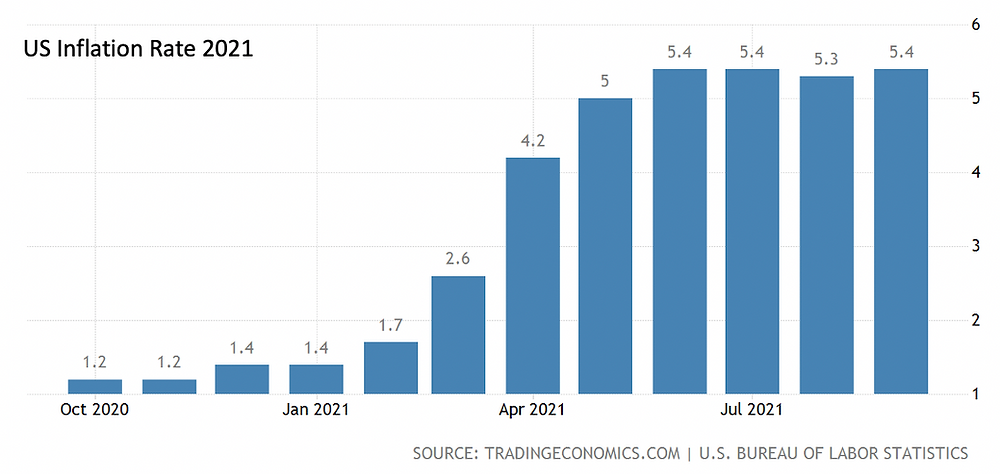

On the other hand, if expectations are a valid indicator of future inflation, then we already have some serious trouble ahead. Inflation expectations are soaring. In the UK the proportion of consumers expecting accelerating inflation is now at a record high.

UPDATE 28/10/21:

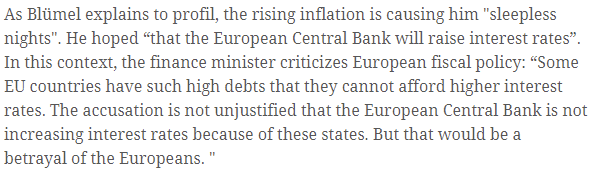

Some EU central bankers are concerned it is already too late to get ahead of inflation because the ECB worries about the debt sustainability of its most vulnerable member states if rates rise even a little:

Source: https://www.profil.at/oesterreich/bluemel-kurz-comeback-kein-problem/401786189

Mr Blumel will be disappointed. The ECB statement released today confirms no rate change, and no imminent change in bond buying, despite massive acceleration in eurozone inflation from the twin energy and supply chain shocks. The same countries vulnerable to an interest rate rise are the same countries likely to experience strikes and civil unrest in response to rising inflation, or inflation-induced state austerity, but I guess the ECB can disclaim accountability for those consequences.

At the press conference which followed President Lagarde said that the ECB had only discussed three things today: "Inflation, inflation and inflation." She indicated the PPP bond buying programme would end March 2022. Nonetheless, there are likely to be either the old Asset Purchase Programme or something else to support more vulnerable economies like Greece.

https://think.ing.com/snaps/ecb-has-finally-woken-up-to-inflation-reality/