The Daisy Chain Hypothesis: Is cross-currency QE behind stealth bond interventions?

Commentary by Kathleen Tyson - April 7, 2023

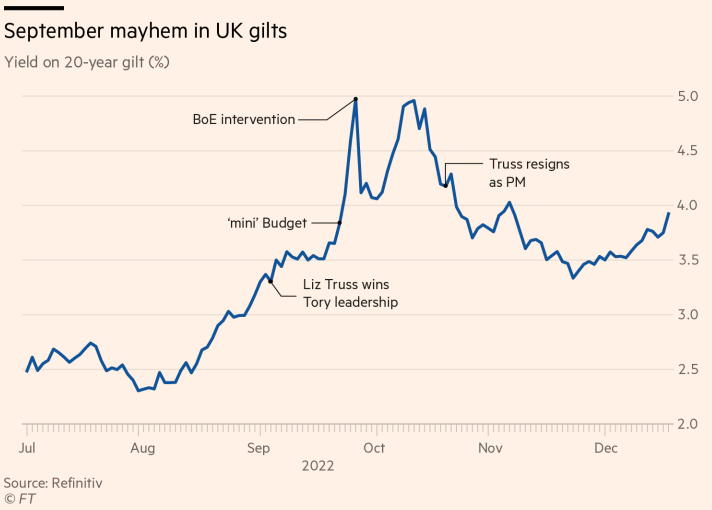

This Commentary explains how a Daisy Chain for financial stability stealth interventions might work. The evidence is growing, but only the Bank of Japan has confirmed stealth intervention in the JGB market, without detailing the mechanism. I first suspected allied central banks might be supporting the UK gilts market during the September 2022 crisis. I then suspected the same mechanism was used in JGBs in October and USTs in November. Let's take a look.

Ouch. I predicted this in July, so I can’t disagree. No one wants to buy Gilts. My guess is UK, US, Canada, Australia and Japan make a daisy chain buying each other’s debt to make it look like there is a functioning market to slow economic implosion. Like 1980s Savings & Loans. https://t.co/uZxNkxnCjt

— Kathleen Tyson (@Kathleen_Tyson_) September 3, 2022

What is a Daisy Chain?

The Daisy Chain concept is quite old, used in various contexts to exaggerate assets on the balance sheet or feign market depth and liquidity. Daisy Chains were used by 1980s Savings & Loans (US mortgage banks) to dress the asset side of the ledger for bank auditors. The executives of a group of Savings & Loans that were all facing bankruptcy would write each other notes (IOUs) for term at interest. The 'investor' S&Ls held these notes on their asset ledgers to make each S&L look healthy, knowing principal would never be paid off. They then offered above market interest rates on deposits to draw in more depositors and put off failure.

Another form of Daisy Chain occurred more recently in the cryptosphere, where crypto exchanges and crypto 'asset' managers executed coordinated wash trades across the conspiring exchanges (buy on one, sell on another) to exaggerate crypto market depth and liquidity and engineer price volatility to their own trading advantage. This activity artificially signalled prices and market robustness so the exchanges could lure new 'investors' to invest their money in crypto. As most crypto exchanges operate from ill-transparent jurisdictions like Bahamas and Cayman Islands, the activity was mostly unscrutinised.

How would a central bank Daisy Chain work?

2022 saw a creditors' strike in government bond markets as central banks, banks, asset managers and others marked down the value of bonds as interest rates rose rapidly. The 20 year benchmark US Treasury bond marked down 29.4 percent. Central banks that mark to market recognised huge losses on FX reserves portfolios, where USD had about 60 percent share at the start of the year. Central banks committed to fighting inflation could not intervene in bond markets with QE domestically as it would signal they were giving up the fight against inflation.

In particular, Japan was selling to support interventions in the Yen under its Yield Curve Control policy. China was selling as tensions with US escalated, switching to large purchases of gold which Peoples Bank of China began announcing again in November.

Faced with bond market instability, central banks might turn to one another for supportive interventions. The Bank of England and the New York Fed have closely cooperated for decades on financial stability. The current governor, Andrew Bailey, was seconded to the New York Fed in the 1980s when we were both very young central bankers. He would have discussed the crisis in gilts as it was unfolding with his closest peer, the president of the New York Fed, John Williams.

The UK does not publish data on foreign ownership comparable to US Treasury TIC data, but market commentaries spoke of growing foreign outflows. Foreign holders were unsettled by political dysfunction in Westminster, the Tory party decision to force Boris Johnson's resignation, and dislike of Liz Truss who replaced him. Her chancellor Kwasi Kwarteng immediately fired the experienced mandarin who ran the Treasury and announced massive unfunded spending without consulting the Bank of England or gilts dealers. It wasn't just foreigners that lost appetite for gilts. The gilts crisis got much worse on 22nd September after the Fed hiked 75 bps and the Bank of England only hiked 50 bps. GBP hit a 37 year low of 1.121 against USD.

The Bank of England intervened as buyer of last resort on Friday, 23rd September. That calmed the market a little, but did not restore foreign appetite for gilts. The market stabilised briefly, but then deteriorated again as the pressure for Truss and Kwarteng to resign intensified. The risk of a global crisis loomed, as the UK is the most exposed nation to foreign creditors. The table below combines both public and private debt, but substantiates that peer G7 central banks might have thought the crisis in the UK would be a globally systemic crisis.

Meanwhile in Tokyo the Bank of Japan was having trouble with its Yield Curve Control policy, having bought up more than half of all JGBs. The Yen, which had fallen steadily against the dollar, was becoming difficult to defend, despite large BoJ interventions. The BoJ sold its US Treasuries to buy yen, communicating its stress to the UST market.

In Europe, too, there was fear that the central banks had raised rates too fast, and something was about to break as mark downs had led to huge margin calls and collateral scarcity. I was in Luxembourg for the Global Funding and Finance Summit at the end of September, and the fear among repo traders was expressed openly. One panellist called for the ECB to coordinate liquidity with other central banks.

Then in November it was the turn of US Treasuries to come under stress. The New York Fed published a blog saying that liquidity conditions in USTs were as bad as the depths of March Madness 2020 when the market failed, communicating panic in fixed income markets globally. Over 400 markets price off UST as a quoted spread above benchmarks. This was not the kind of systemic risk any central banker could ignore.

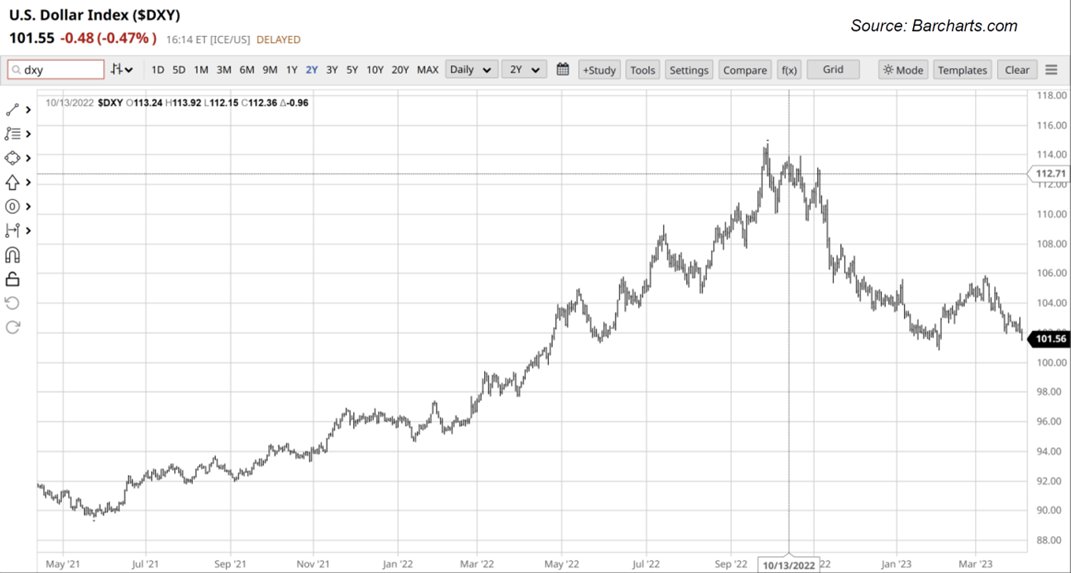

Secretary of the Treasury Yellen went from saying 10 October that the Treasuries market was fine, to saying just a day later that she was worried about market functioning. What changed? Later in the day on the 10th she met with her G7 peers in Washington at the IMF/World Bank meetings, and Bloomberg reported that they discussed the strength of the dollar and global financial stability. Everything changed instantly in markets from that day.

What is the evidence for a Daisy Chain?

Discussing it with others on Twitter, they confirmed the likelihood of a coordinated stealth intervention in all cooperating central bank markets. The effect in the US was dramatic. Thanks for the charts, @LukeGromen.

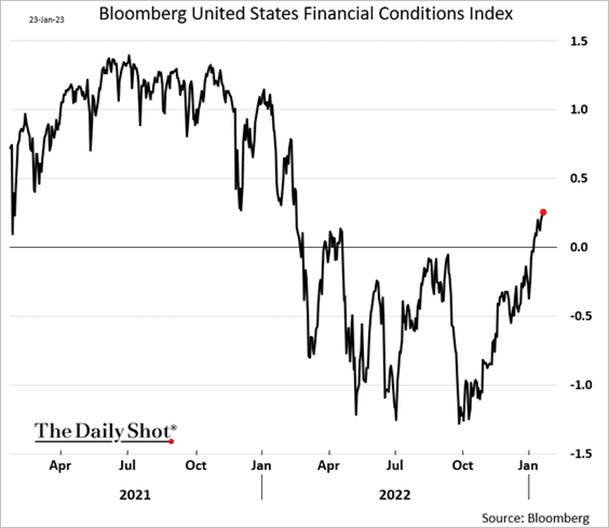

The S&P 500 went from intra-year lows to a strong recovery. The dollar began falling against other currencies. So something had clearly changed to loosen financial conditions globally, but only the governor of the Bank of Japan admitted to a 'stealth intervention'. Bloomberg's Financial Conditions Index soared.

So curiouser and curiouser. I wanted to know if there was stealth QE going on, but central banks aren't very transparent about reserves interventions, and a stealth QE to purchase foreign assets might run afoul of Dodd Franks Act curbs on Fed discretion to intervene to support foreign banks.

Back at the Global Funding and Finance Summit in Luxembourg in February, I asked around. The same bankers that had been white-knuckled with fear in October were laughing, happy, rolling in liquidity. They didn't know where it had come from, but there was no collateral scarcity or apprehension of market failure. Indeed, repo growth had been strong in the two quarters since the previous GFF Summit, surging to $10.4 trillion in daily interbank repos on average.

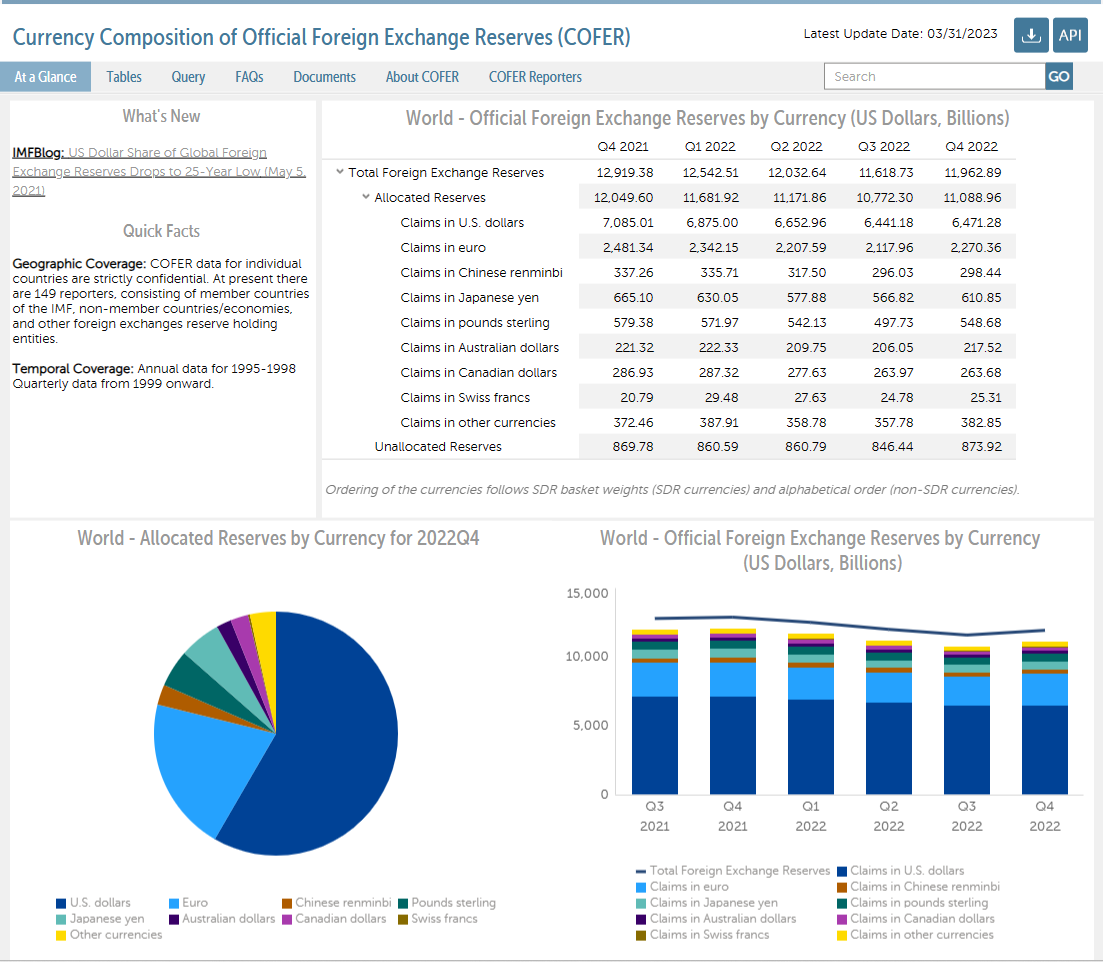

The only place I could think might confirm collaborative cross-currency QE was the COFER data published by the IMF quarterly. The Q4 2022 data was released 31st March, and it confirms strong FX reserves growth among the countries I had predicted in September: USD $30.1, EUR $152.4, JPY $44.03, GBP $50.95, AUS $11.47. That's as close to a smoking gun as we are going to get on the Daisy Chain hypothesis.

Central banks are secretive about the allocation of FX reserves. Although the IMF collects the data and publishes aggregates, it keeps the reported holdings of individual central banks strictly confidential. If you wanted to do stealth QE to stabilise bond markets and make them appear less volatile and more robust, hiding the purchased assets in FX reserves would be a discreet way to do it. While QE in domestic markets would be heavily scrutinised and subject to political criticism, QE to buy bonds in a peer's market might pass by unobserved.

Some of the moves observed were FX adjustment related as the USD began to weaken in this timescale. Meanwhile, JPY +10.4%, Euro +9.2%, GBP +8.2%. As these currencies strengthened the value of FX reserves in dollar terms increased, accounting for some part of the observed COFER growth.

Does the Daisy Chain continue to coordinate interventions?

The Federal Reserve changed its policy on central bank swap lines to permit daily use, rather than weekly. The press release is the same date as the forced merger of Credit Suisse with larger rival UBS, an event which wiped out $17.5 billion of AT1 bondholders under emergency Swiss legislation. The wider market for bank debt was destabilised by the default. Central banks might well apprehend more outflows and margin calls. Daily liquidity in USD would enable peers to buy US Treasuries as needed if the UST market became dysfunctional again.

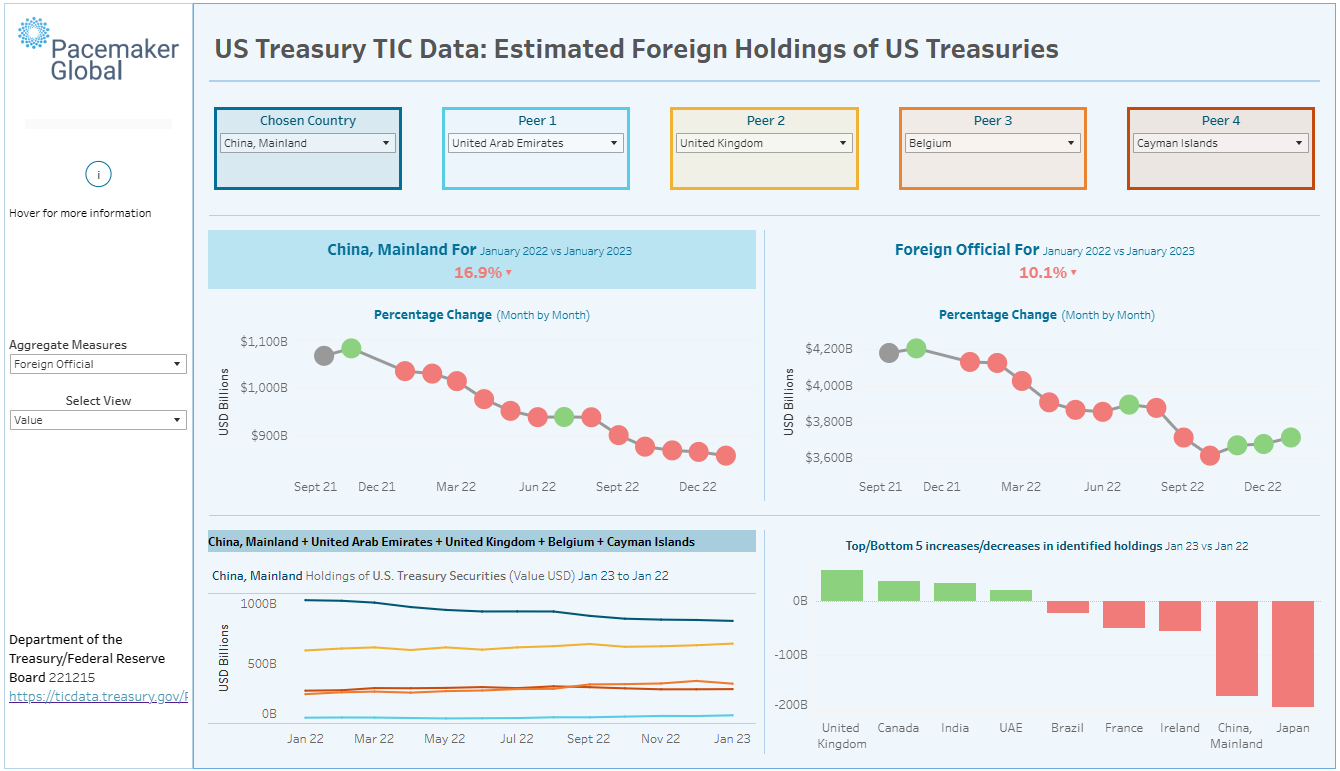

We've built the TIC Tool at Pacemaker.Global to help us watch inflows and outflows to USTs. Let's look at it for the most recent data, January 2023. Official holdings have increased for the 3 months since the October stress in markets was recognised by Secretary Yellen. The biggest annual buyers are now close allies UK and Canada. The TIC methodology uses hybrid valuation: mark-to-market for long-term securities, par value for short-dated bills, so FX volatility factors into apparent increases/decreases in holdings from month to month.

I'll leave you to make up your own minds about whether the Daisy Chain exists. Maybe some day a central banker will tell us. The IMF preaches intervention transparency to EMDEs, so perhaps they might ask a few questions about the Daisy Chain and the curious pattern of reserves growth among G7 and allied central banks from Q4 2022.

In the meanwhile, we will continue to update our TIC Tool monthly. Subscribe or contribute to support us!