The 'Extraterritorial' US Dollar

Commentary by Kathleen Tyson - April 12, 2023

France's President Macron, on his flight returning from China this week, stated that the EU should oppose the ‘extraterritoriality of the US dollar’. He’s right. Here’s a history lesson in how the dollar became ‘extraterritorial’ and the injustice and risks extraterritoriality imposes on the world.

For four hundred years it was an accepted principle of customary international law that a claim against a bank branch could only be enforced in the jurisdiction in which the branch was located under that jurisdiction’s relevant laws. If you open a deposit account in London the laws of England apply. If you open an account in Delhi the laws of India apply. Makes sense, right? After all, opening a bank account forms a contract between the branch and the accountholder, and banking laws vary from jurisdiction to jurisdiction.

This fundamental legal principle is known as the ‘separate entity doctrine' because international law recognises each branch as a juridical entity separate from the bank. Banks of the world organised systems of bank branches globally on this legal principle, and it is essential to managing the risks of global finance. Any judicial claim or attachment order must be directed against the property of the deposit claim at the branch, served on the branch where the account is recorded and maintained.

The ’separate entity doctrine' protects banks from having a claim that is expropriated in one place by authorities asserted against the bank in another place. This was very important in the 1970s when many countries nationalised branches of big banks like Citibank. Without the ‘separate entity’ doctrine the depositors who lost money in the Philippines when Citibank was nationalised would be able to come after their money against the bank in New York, exposing Citibank to huge risk of losing the money twice.

In the mid-1980s the SEC lodged a case against Mssrs Wang, Lee & Lee for insider dealing. Mr Lee was a Taiwanese national resident in Hong Kong. As I recall, the case was uncontested, so the SEC issued a ruling in its own favour and assessed damages on behalf of the ‘victims’. The SEC then issued an order for damages against Mr Lee, and the US Treasury assessed a fine against Mr Lee.

Standard Chartered is a UK bank with branches and subsidiaries in 60 countries, including more than 100 branches in Hong Kong and 1 branch in New York. Standard Chartered was not involved with Mr Lee’s alleged wrongdoing in the United States in any way, nor did Mr Lee have an account at the New York branch.

The SEC alleged Mr Lee had control over several corporate accounts at a Standard Chartered Hong Kong branch. The SEC offered no evidence for its assertion, which the corporations themselves strongly denied. Nor did the SEC offer any evidence that funds in the corporate accounts in Hong Kong had accrued from the alleged insider dealing of Mr Lee in the United States.

The corporations were Hong Kong corporations. The corporate accounts with the Hong Kong branch were expressly held under Hong Kong law. The SEC should have gone to Hong Kong to prove that Mr Lee had control of the corporations, prove the proceeds of the insider dealing had gone to the corporations, and ask a Hong Kong court to award the corporate funds to the SEC.

Too complicated! The SEC made a cumulative claim for $12,500,000 payment against the New York branch of Standard Chartered that had no connection to Mr Lee, no connection to the corporations in Hong Kong, and no involvement in the SEC insider dealing case.

New York District Judge Richard Owen ordered the SCB New York branch to pay $12,500,000 to the court registry for the SEC and US Treasury. This cumulative demand was against Hong Kong branch corporate account balances held in US dollars as well as balances maintained in Hong Kong dollars, yen, sterling and other currencies. SCB’s New York branch complied by paying its own funds to the court registry under protest and appealed.

If I remember the learned Judge Owen’s statement and order accurately, it was: “I’m an American judge. This is an American court. This is a claim for American dollars. Pay the court registry.”

That’s American justice for you! No evidence. No due process. No evidential case. No legal analysis. No respect for precedent or customary international law. No recognition that other countries have laws too. Just do as you’re told or else!

SCB’s Hong Kong branch was still liable for all balances to the Hong Kong corporate accountholders, none of whom were party to the SEC action, and all of whom denied that Lee had any ownership or control over their corporations or corporate accounts. SCB faced double liability if the claims on Hong Kong accounts were enforced in both New York and Hong Kong, so litigation started in Hong Kong too.

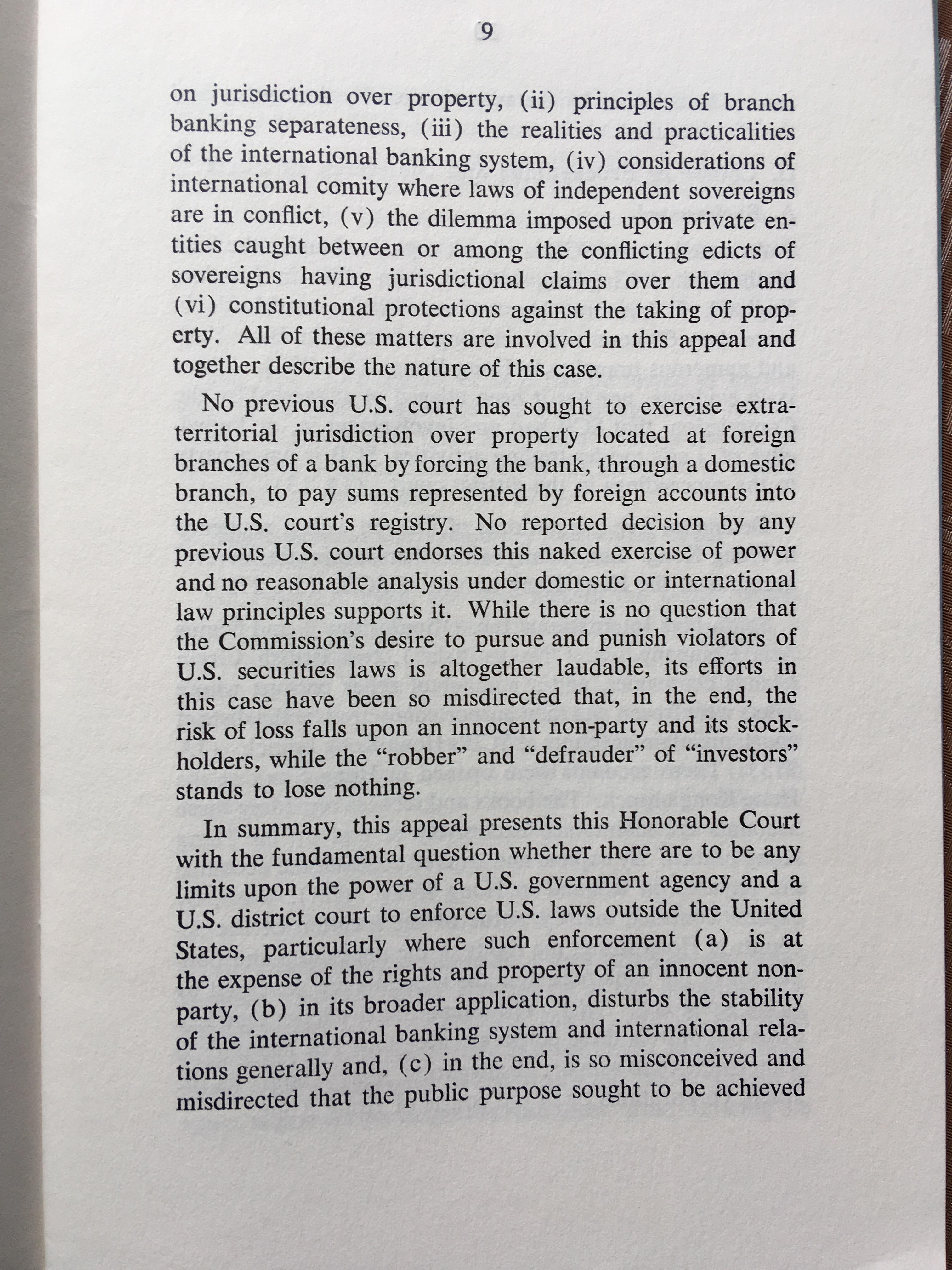

It is unusual for one part of government to brief against another, but the New York Fed filed an amicus brief supporting Standard Chartered Bank on appeal because it viewed Judge Owen’s order as a threat to the global banking system. The briefs of Standard Chartered Bank and my own brief are on my desk now, and I’ll scan them to PDF if anyone out there wants them.

The appeals court confirmed Judge Owen’s order, Securities and Exchange Commission v Stephen Sui-Kuan Wang, Jr., Fred C. Lee, a/k/a Chwan Hong Lee, Defendants, Chartered Bank, Appellant, 88-6236, 6316, 2nd Circuit Court of Appeals. Standard Chartered elected not to take the case to the Supreme Court, even though the New York Fed encouraged them to do so.

The ‘extraterritoriality’ of the dollar started with ignorance, arrogance, and a huge injustice, and it only got worse and more unjust after. Once the US Treasury got its head around the idea that all US dollar claims anywhere in the world could be enforced as claims in New York, it started rolling out extraterritorial rules for all those claims. Every US regulation on transaction reporting, KYC, AML-CTF, FATCA is based on the singularly ignorant and fundamentally unjust order of Judge Owen in 1988. Then the US expanded its extraterritorial overreach to corruption, money laundering, terrorism, sanctions, embargoes, and the list goes on and on.

A good article from the EU perspective is at the International Bar Association United States Extraterritoriality: European Union sovereignty at stake. The title says President Macron is absolutely right.

The world went along with the hugely burdensome Treasury regulations and fines because the US dollar was the global currency, the indispensable currency. Any attempt to question the US Treasury could see your bank cut off from the global banking system, your executives and even lawyers sanctioned. The global banking system rolled over and took the costs of regulation, reporting, tens of billions of dollars in US Treasury fines, and massive injustice after injustice because dollars.

President Macron has done the world a huge favour by saying, ‘Enough’. The EU and the world should move away from dollars and the injustice of American extraterritorial overreach. They should re-establish the universality of the 'separate entity doctrine'. If they want help, I'm up for re-litigating, and I kept the briefs.

Standard Chartered Bank and the entire world lost the appeals case in 1989, but it's not too late to correct that injustice and rebuild legal doctrines on UN principles of sovereignty and legal comity now.

The image below is from page 9 of the Standard Chartered brief. I've scanned and uploaded the Sullivan & Cromwell brief for SCB and the New York Fed amicus brief HERE.